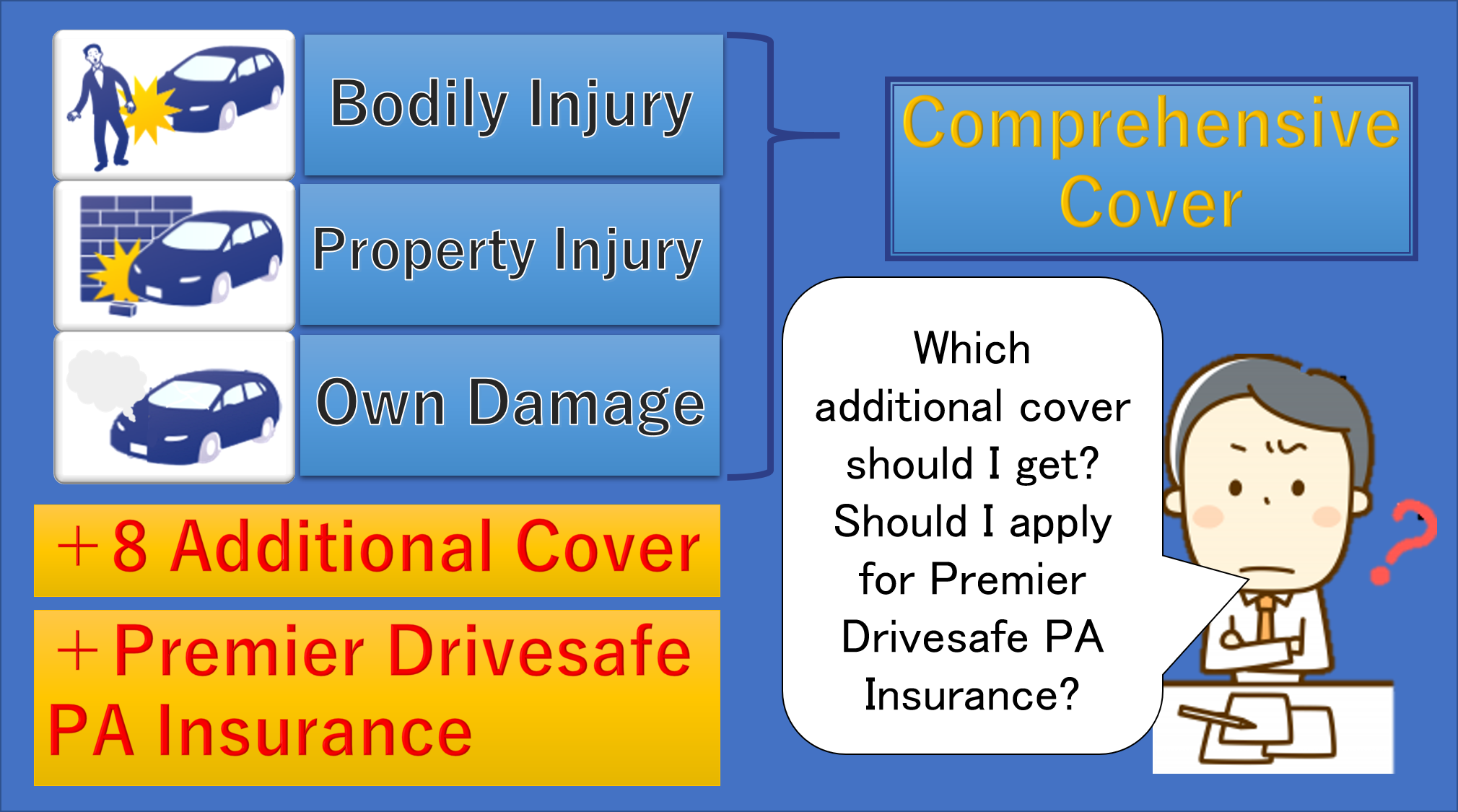

WE explained Motor Insurance “Comprehensive Cover” in Malaysia as the introduction in the previous article

Compressive cover has three types : Bodily Injury, Property Injury, and Own Damage. It is generally offered as a set.

If you are not sure whether you should apply for Additional Cover and Premier Drivesafe PA Insurance, we will explain about them.

You can choose from 8 different types of “Additional Cover” and “Premier Drivesafe PA Insurance” that give you a guaranteed in safety driving.

It is an optional which you can possibly avoid to apply any of it.

Get the best motor insurance for you.

Additional Cover is as follows:

Covering your legal liability to your passengers due to taking possession, using or under control of your vehicle.

Covering your legal liability to your passengers due to taking possession, using or under control of your vehicle.

【e.g】In the case a passenger who is in the car is injured due to a driver’s driving mistake, this option will cover the amount of compensation as long as the driver is responsible for the liability of the passenger.

【Insurance Fee】

RM30-50 (For Perodua. It depends on vehicle sum insured.)

【★★★★★】Most people apply for it. You should have it in case you put your friends or guests in your car.

It covers legal liability of passengers to third party.

It covers legal liability of passengers to third party.

【e.g】In the case your kid suddenly opens the car door and a motorcycle running from behind bumps into the door and the person on the motorcycle is injured, the option will cover the amount of compensation.

【Insurance Fee】

RM7.50 (Fixed)

【★★★★★】Most people apply for it as it is not expensive

It covers accidental breakage of glass in the windscreen. This coverage shall be deemed to be insured separately and not to affect NCD.

【Insurance Fee】

RM120-180 (For Perodua.)

*15% of the amount of the windscreen.

【★★★★】Most people apply for it because windshield chip often happens in Malaysia.

In case the Insured take up this clause Compulsory Excess amounting RM 400 is not applied even though unnamed driver* drives and has an accident.

In case the Insured take up this clause Compulsory Excess amounting RM 400 is not applied even though unnamed driver* drives and has an accident.

*You can name up to 2 people for free.

Compulsory Excess is self-payment for repairs. If the repair cost is RM2,000, insurance company pay RM1,600 and the driver has to pay RM400.

【e.g.】You rented my car to my friend and he had a car accident. The repair cost is RM3,000 but this option allows you not to pay for this.

【Insurance Fee】

Individual: RM15 (fixed)

Company: RM50 (fixed)

【★★★】If you have some opportunities to have your friends drive your car, you may apply for it.

It covers damage caused by natural disasters such as floods, storms, typhoons, hurricanes, eruptions, earthquakes, landslides.

It covers damage caused by natural disasters such as floods, storms, typhoons, hurricanes, eruptions, earthquakes, landslides.

【Insurance Fee】

0.35% of vehicle sum insured

【★★】Mainly for those who live in areas where you concerned about floods and landslides during the rainy season

When repairing due to an accident, you will be compensated for the fixed daily benefit specified at the time of contract. It doesn’t matter whether you use a replacement car or not.

【e.g.】I had a car accident and It took me 5 days to repair the car. I didn’t use a rental car then, but I could get RM350 ( RM50 / 7days ) because I had applied for this cover for RM35 a year.

【Insurance Fee】

RM35 (Coverage: RM50 / 7days)

RM420 (Coverage: RM200 / 21days)

*It depends on coverage and days.

【★★】

It covers accidental breakage of vehicle accessory such as radio, air-conditioner, etc. This coverage shall be deemed to be insured separately and not to affect NCD.

【Insurance Fee】

15% of the amount of the accessory.

【★★】

The damage caused by the assault and riot of the strike participants that will be covered.

【Insurance Fee】

0.3% of vehicle sum insured

【★】

Premier Drivesafe Personal Accident Insurance protects you and/or your passengers against injuries and death while entering, riding, driving or alighting from the car. This is an insurance contracted for the car. The Personal Accident benefit can no longer be insured if you get in another car.

★★★★★This insurance is not compulsory , but it is highly recommended.

“Comprehensive Cover ” does not include compensation for injuries to drivers or passengers. However, Premier Drivesafe PA Insurance compensate the driver and his/her passenger for injuries and deaths, no matter who causes the accident.

A person should stay cautious when it come to driving. Anything unexpected can happen to you or your car might be hit by another car even if we drive safely.

If compensation from the person responsible for the accident is not paid accordingly, you have to pay hospital bills at your own expense. If you have Premier Drivesafe PA Insurance, you can receive insurance as soon as the symptoms of the injury are confirmed. It is recommended in preparation of the case that your family or friends should go to the hospital.

In addition, compensation for injuries to the driver and his/her passengers, car rental fee, hotel accommodations and/or taxi fare that are inevitable can be paid up to the maximum limit.

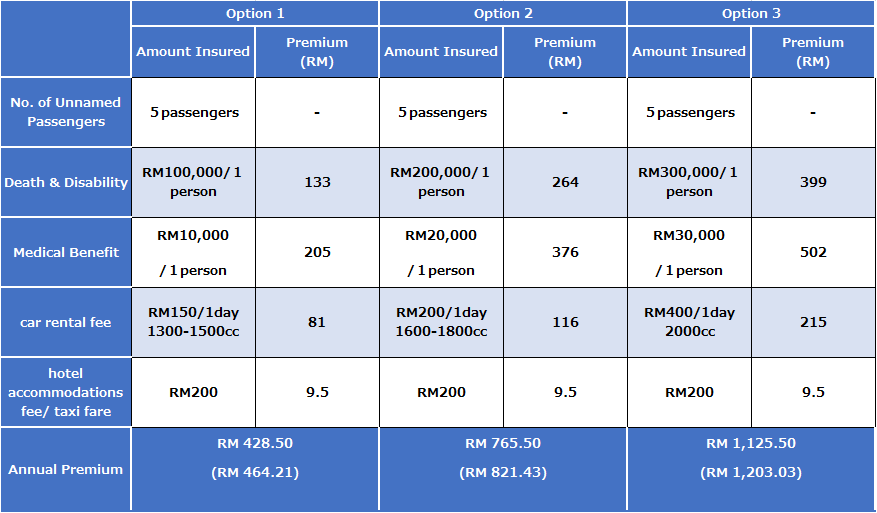

Tokio Marine Malaysia offers three plans of Premier Drivesafe PA Insurance .

Tokio Marine Malaysia offers three plans of Premier Drivesafe PA Insurance .

The higher the annual premium, the more generous compensation in case of an emergency.

―Rating / Premium Computation (Example)―

―Rating / Premium Computation (Example)―

Beside these plans, we can also propose some plans based on your needs and your budget.

If you would like to know more about car insurance, please feel free to contact us.